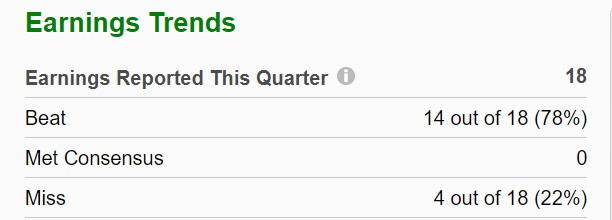

The Zacks computer software industry continues to stand out this earnings season with many stocks in the space beating their bottom line expectations, including tech giant Microsoft (MSFT – free report) . Accompanying Microsoft, 14 of the 18 companies that have released their quarterly results so far have exceeded earnings estimates.

Furthermore, several of these computer software stocks currently hold spots on the Zacks Rank #1 (Strong Buy) list, and here are three to consider.

Image source: Zacks Investment Research

Cadence Design Systems (CDNS – free report)

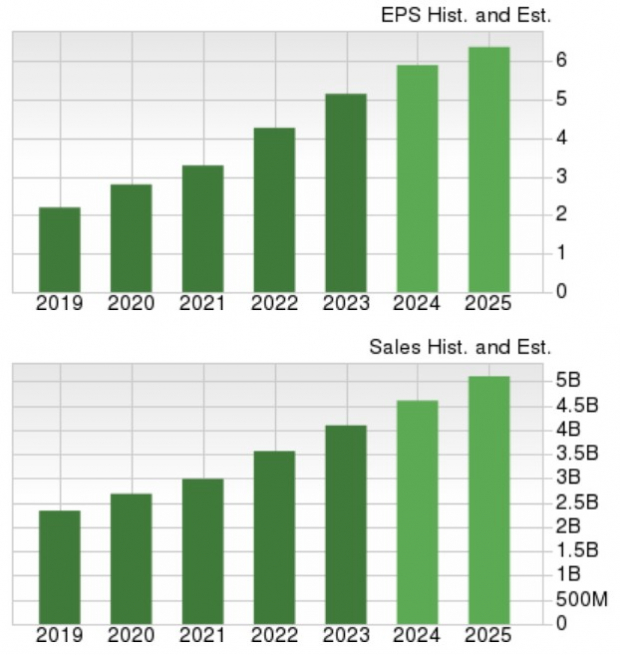

Cadence Design Systems’ continued growth remains attractive as a provider of computer software, hardware and IP that turns design concepts into reality. The attractive growth narrative was reiterated with fourth-quarter earnings of $1.38 per share that beat estimates by 3% last Monday and soared 44% from $0.96 per share in the comparable quarter.

Annual earnings rose 20% in fiscal 2023 to $5.15 per share, with total sales of $4.09 billion up 15%. Artificial intelligence and 3D integrated circuits (ICs) should give the company a push for the future in terms of improved performance and reduced power consumption. In correlation with this, Cadence Design Systems is forecast to achieve double-digit top- and bottom-line growth in FY24 and FY25.

Image source: Zacks Investment Research

Manhattan Associates (MANCH – free report)

With its software dedicated to supply chain execution and optimization solutions, Manhattan Associates is a stock to watch after the pandemic has shown deficiencies in this area of startups in many countries, including the United States.

Manhattan Associates is now believed to have more than 1,200 clients worldwide spanning a variety of industries including the retail, grocery, consumer packaged goods, healthcare and automotive markets. The omnichannel commerce solutions provider experienced strong momentum by reporting record fourth-quarter revenue of $238.26 million in late January. More impressively, fourth-quarter earnings of $1.03 per share beat estimates by 29% and rose 27% from $0.81 per share a year ago. It’s also worth mentioning that Manhattan Associates has now topped the Zacks EPS Consensus for an incredible 24 consecutive quarters and has posted an average earnings surprise of 27.6% over the last four quarterly reports.

Image source: Zacks Investment Research

Manhattan Associates’ annual earnings jumped 35% to $3.74 per share last year, and FY24 earnings are expected to be about the same. However, FY25 EPS is forecast to jump 15% to $4.33 per share, and double-digit sales growth is further reason to believe in Manhattan Associates’ earnings potential.

Image source: Zacks Investment Research

Pegasystems (SPOT – free report)

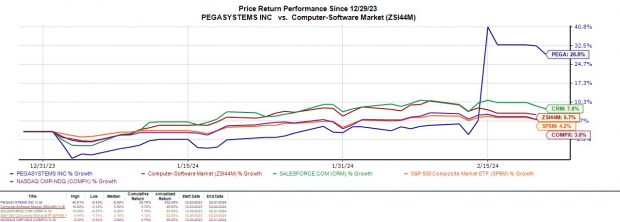

CRM software vendor Pegasystems is certainly worth investors’ consideration after fourth-quarter earnings of $1.77 per share crushed estimates of $1.07 per share by 65% last Wednesday. Even better, fourth-quarter earnings were up 116% from $0.82 per share in the year-ago quarter. Annual EPS of $2.48 was a company record, which Pegasystems attributed to strong cash flow growth.

Looking ahead, earnings are expected to grow roughly 1% in FY24, then rise 19% in FY25 to $2.99 per share. Interestingly, Pegasystems stock has been one of the best performers so far this year, jumping +29% to greatly outperform the broader indexes, Zacks Computer-Software Market +6% and fellow CRM software leader Salesforce (CRM – free report) +8%.

Image source: Zacks Investment Research

The point

The increased profitability of these computer software companies is very tempting right now. Attribution to their strong buy ratings, earnings estimates revisions have continued to rise for their current 24th and 25th fiscal years, making now an ideal time to buy shares of Cadence Design Systems, Manhattan Associates, and Pegasystems.