One of the rising stars among artificial intelligence (AI) developers is Palantir Technologies (NYSE: PLTR). The company markets its data analysis software under three monikers: Foundry, Apollo and Gotham. The company sells these platforms to both the private and public sectors and provides a wide range of capabilities, including data collection, security protocols and trend analysis.

In April 2023, Palantir launched its fourth product: the Artificial Intelligence Platform (AIP). In a world increasingly dominated by ChatGPT and high-performance graphics processing units (GPUs), you may have missed Palantir’s milestone last year.

AIP has been an incredible success. Just last week, Palantir hosted a live event where customers showcased how AIP is transforming their business. As part of the marketing campaign, Palantir CEO Alex Karp sat down for an interview during which he stated, “We don’t play golf, we play software.”

I found this assumption both comical and intriguing. Let’s break down what Karp might be alluding to and assess how Palantir is quietly emerging as an AI superstar.

Palantir has a unique approach to sales and marketing

Sales and marketing is one of the most demanding professions. Businesses spend a lot of money trying to acquire new customers and nurture existing accounts. One common form of customer success is getting to know your customers on a personal level — discovering their interests and shaping your retention efforts around those dynamics.

Anecdotally, as a sports enthusiast, when I worked at a tech start-up a few years ago, managers would invite me to attend games in luxury suites — fully equipped. Moreover, sales representatives in my own company would invite potential clients to dinner, concerts, or a pleasant afternoon on the golf course.

Palantir takes a much different approach to lead generation. The company does away with the dining and dining aspect of customer acquisition entirely. Instead, after the release of the AIP, Palantir began organizing comprehensive seminars called “boot camps”.

During these events, potential customers have the opportunity to demonstrate Palantir’s various software platforms and identify an AI-centric use case.

Customer acquisition is on the rise

I look at boot camps as more than just a funnel to fill leads. Rather than kidding, Karp and his team are so confident in Palantir’s capabilities from a product standpoint that they actually invite potential customers to come and test drive it. This is the definition of putting your money where your mouth is.

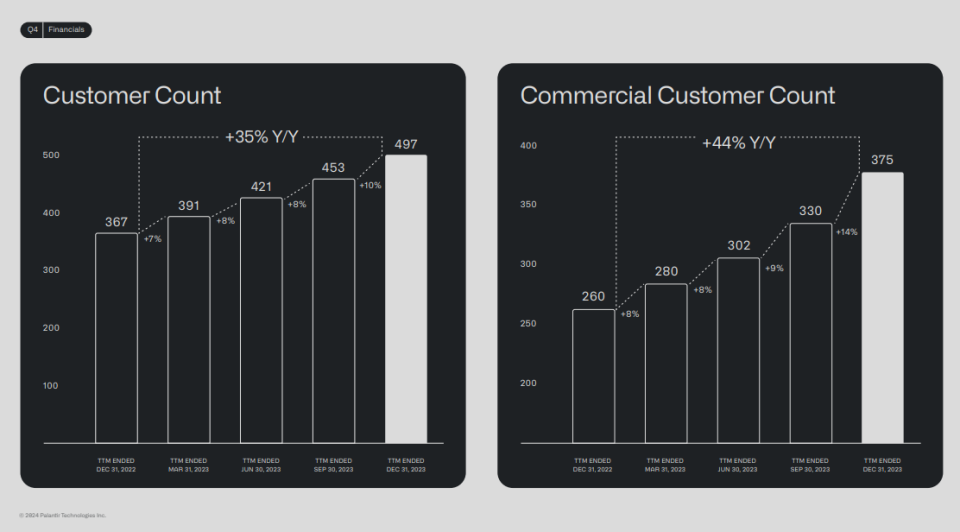

During 2022, Palantir hosted 92 customer demo pilots. Since the release of AIP last April, the company has conducted 850 bootcamps. Indeed, the charts above undermine the fact that these bootcamps are driving demand and users are switching to paid accounts.

The combination of Karp’s hot moves and the clear success of AIP bootcamps is helping Palantir strengthen its brand. This is important as the company faces fierce competition from peers MicrosoftDatabricks, and even Amazon.

Is now a good time to invest in Palantir?

Shares of Palantir have been on the rise over the past year. Shares have jumped 167% in 2023 and are up 49% so far this year.

Given the increased buying activity, Palantir’s valuation multiples have become slightly stretched. The stock currently trades at a price-to-sales (P/S) multiple of 26.9, which is significantly higher than many of Palantir’s software-as-a-service (SaaS) peers.

However, long-term investors understand that timing the market is far more important than trying to time the market.

While Palantir stock is enjoying a moment, the AI company’s journey is just beginning. As such, a prudent approach to investing in Palantir might be to use dollar cost averaging and grow your position over time, as long as your investment thesis and risk profile remain unchanged.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider the following:

The Motley Fool Stock Advisor a team of analysts has just identified what it believes to be 10 best stocks for investors to buy now… and Palantir Technologies was not one of them. Ten Stocks That Dimmed Could Produce Monster Returns in the Coming Years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio construction guidance, regular updates from analysts, and two new stock picks each month. The Stock Advisor the service has more than tripled the return of the S&P 500 since 2002*.

See 10 stocks

*Stock Advisor returns from March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions at Amazon, Microsoft and Palantir Technologies. The Motley Fool has positions in and recommends Amazon, Microsoft and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The CEO of Palantir just said, “We don’t play golf, we play software.” Here is my interpretation. was originally published by The Motley Fool