Smith Micro Software (SMS – Free Report) has signed a new contract with a US-based mobile operator to implement the SafePath solution for its subscribers. This is the first user to launch SafePath Global.

SafePath Global enables carriers to quickly offer their customers all the capabilities of the SafePath application and enables users to obtain a family safety solution. This simplifies or eliminates many of the difficulties associated with implementing family safety solutions, including cost, resource constraints and multiple decision points.

The SafePath platform consists of SafePath Family, SafePath IoT, SafePath Home, SafePath Drive, etc. It provides comprehensive and simple tools to protect your digital lifestyle and manage connected devices through a single application.

The company is a leading provider of embedded software for networked devices, policy-based management platforms, and mobile applications and hosted services. It plans to launch SafePath Premium to further expand its SafePath portfolio. The solution is expected to be available in the second half of this year.

In February, the company introduced SafePath OS, a new family security solution built on the Android operating system. The solution improves digital safety for children and families as SafePath OS will expand the company’s reach from a subscription-only application solution to enabling MNOs to offer devices powered by SafePath OS. The solution is expected to be available in the second half of this year.

The company also announced that its board of directors has approved a 1-for-8 reverse split of its common stock. The reverse split will become legally effective on April 10, 2024, the company added. The objective of the reverse split is to raise the share price so that it can once again meet the minimum offer price required to remain listed on the Nasdaq Capital Market.

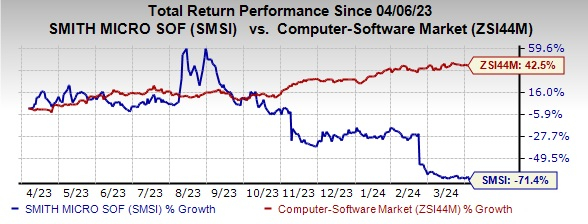

SMSI currently has a Zacks Rank #4 (Sell). SMSI shares have lost 71.4% in the past year compared to the sub-industry’s growth of 42.5%.

Image source: Zacks Investment Research

Stocks to consider

Some higher-ranked stocks from the broader technology space are Synopsis (SNPS – free report), Forest ranger (WWD – Free Report) i Perion network (WASH – Free report). Synopsys and Perion Network carry a Zacks Rank #1 (Strong Buy), while Woodward carries a Zacks Rank #2 (Buy). You can see a complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Synopsys’ 2024 earnings per share (EPS) improved by 0.3% over the past 60 days to $13.46. SNPS’s long-term earnings growth rate is 17.5%.

Synopsys’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 4.1%. SNPS shares have risen 56.1% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 earnings per share has risen 5.7% over the past 60 days to $5.27. WWD’s long-term earnings growth rate is 15.5%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 27.2%. WWD shares are up 62.3% in the past year.

The Zacks Consensus Estimate for Perion Networks’ fiscal 2024 EPS improved by 0.6% over the past 60 days to $3.34. PERI’s long-term earnings growth rate is 22%.

The company’s earnings have topped the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 12.9%. PERI shares have lost 42% in the past year.