Magic Software Enterprises Ltd. (NASDAQ:MGIC) defied analysts’ forecasts by posting annual results that came in ahead of market expectations. The company beat expectations with revenue of $535 million, which was 2.0% higher than forecast. Statutory earnings per share (EPS) were $0.75, 8.7% above estimates. Earnings is an important time for investors because they can monitor the company’s performance, see what analysts are predicting for the next year, and see if there has been a change in sentiment toward the company. With that in mind, we’ve rounded up the latest legislative predictions to see what analysts expect for next year.

Check out our latest analysis for Magic Software Enterprises

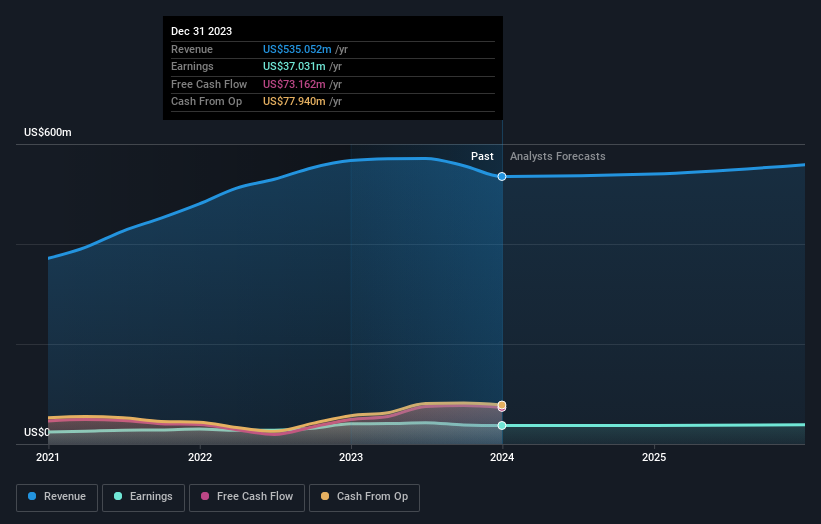

Taking into account the latest results, the individual analyst at Magic Software Enterprises is currently expecting 2024 revenue of $540.0 million, roughly in line with the last 12 months. Statutory earnings per share are expected to be $0.75, which is about the same as the last 12 months. However, prior to the latest earnings, the analyst was expecting revenue of $473.8 million and earnings per share (EPS) of $0.61 in 2024. So we can see that there was a pretty clear increase in sentiment after the latest results, with both revenues and earnings per share, which according to the latest estimates are decent.

It will come as no surprise to learn that the analyst raised his price target on Magic Software Enterprises by 7.7% to $14.00 based on these upgrades.

One way to get more context about these forecasts is to look at how they compare to past performance and to the performance of other companies in the same industry. We’d point out that Magic Software Enterprises’ revenue growth is expected to decelerate, with a forecast annual growth rate of 0.9% through the end of 2024, well below its historical growth of 16% annually over the past five years. By comparison, other companies in this industry with analyst coverage are forecasting revenue growth of 12% annually. Considering the projected slowdown in growth, it seems obvious that Magic Software Enterprises is also expected to grow more slowly than other industry participants.

The bottom line

The most important thing here is that the analyst improved his earnings per share estimates, suggesting that there has been a clear increase in optimism about Magic Software Enterprises following these results. They also improved their revenue estimates for next year, although they are expected to grow more slowly than the broader industry. There was also a nice increase in the target price, with the analyst clearly feeling that the intrinsic value of the business is improving.

In this regard, a company’s long-term earnings trajectory is much more important than next year. At least one analyst has provided forecasts up to 2025, which can be viewed for free on our platform here.

However, before you get too excited, we’ve got the scoop 1 warning sign for Magic Software Enterprises which you should be aware of.

Have feedback on this article? Worried about the content? Get in touch directly with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account recent price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.