Cadence Design Systems, Inc CDNS’ top performance is due to solid demand for its diverse product portfolio.

Cadence offers products and tools that help users design electronic products. The company’s core electronic design automation software and services enable engineers to develop various types of integrated circuits.

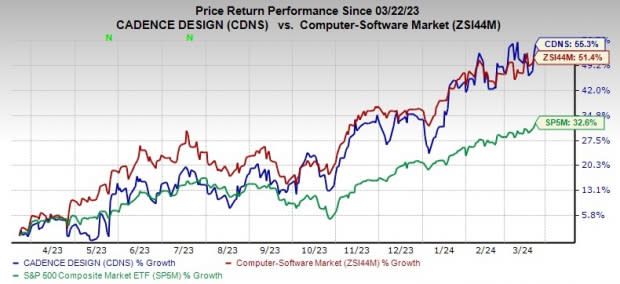

A solid financial performance also led to a good result on the commercial front. The company’s shares have gained 55.3% in the past year, compared with subindustry and S&P 500 Composite gains of 51.4% and 32.6%, respectively.

With sound fundamentals and strong growth opportunities, this Zacks Rank #1 (Strong Buy) stock appears to be a good investment option right now.

Image source: Zacks Investment Research

Cadence’s 2024 and 2025 EPS are expected to grow 15.2% and 18.2% from year-ago levels to $5.93 and $7.02, respectively. The Zacks Consensus Estimate for 2024 and 2025 earnings per share improved by 3% and 7.7%, respectively, over the past 60 days.

The long-term earnings growth rate is 17.1%. CDNS has beaten estimates in each of the last four quarters, delivering an average earnings surprise of 3.4%.

Revenues for 2024 and 2025 are forecast to grow 12.2% and 12.7% year-over-year to $4.59 billion and $5.17 billion, respectively.

Growth catalysts

Accelerated design activity thanks to transformative generational trends such as generative artificial intelligence, hyperscale computing, 5G and autonomous driving is likely to advance the top line in the future. The momentum in 3D-IC and chiplet design bodes well.

Digital IC business grew 22% year-over-year in the last quarter. CDNS digital full flow was accepted by 34 additional users during 2023.

The functional verification business is gaining momentum due to the increasing complexity of system verification and software deployment. Revenues from this segment grew 11% year-on-year in the fourth quarter of 2023.

Demand for CDNS hardware systems remains strong. The Palladium and Protium platforms (especially the Z2 and X2) had continued appeal with many deals won. It added 26 new and more than 110 regular customers during 2023.

The company also announced a new set of applications designed to enhance the capabilities of its flagship Palladium Z2 Enterprise Emulation System. Applications are domain-specific applications that are tailored to help users navigate the increasing complexity of system design.

Expanding its well-established partnerships with strategic partners such as NVIDIA, Arm and Intel is a tailwind.

Recently, Cadence took a step forward in its multi-year agreement with NVIDIA to drive innovation in artificial intelligence, systems design and analysis, digital biology, and electronic design automation.

The partners presented two solutions that include a digital dual platform driven by artificial intelligence. In addition to the dual platform, CDNS’s Orion platform will now have access to NVIDIA’s BioNeMo platform for rapid drug discovery.

Synergies from acquisitions

Strategic acquisitions have also played a key role in driving top performance. In March 2024, Cadence signed an agreement to acquire a leading provider of engineering simulation solutions — BETA CAE Systems International AG. The acquisition is likely to advance Cadence’s Intelligent Systems Design strategy by expanding its multiphysics systems analysis offering and helping it enter the structural analysis sector.

Multiphysics simulations are becoming important early in the design cycle due to increasing system complexity and time-to-market challenges driven by accelerated mechanical and electrical hyperconvergence and the digital revolution of many industries.

The deal includes a payment to Cadence of approximately $1.24 billion, with 60% of the consideration in cash and 40% through the issuance of shares to BETA CAE shareholders. The deal is expected to close in the second quarter of 2024, subject to regulatory approvals.

In January 2024, the company acquired California-based embedded software and system-level solutions provider Invecas, Inc. The acquisition of Invecas adds a skilled engineering team (headquartered in Hyderabad, India), which will help CDNS offer its customers worldwide customized solutions in chip design, advanced packaging, manufacturing engineering and embedded software.

Apart from Invecas, it also acquired Intrinsix to expand its footprint in the advanced node, radio frequency, mixed signal and security algorithm space. The acquisition of Pointwise and NUMECA was also aimed at increasing the systems analysis portfolio with more CFD solutions. The acquisition of OpenEye Scientific Software will help increase its reach in the pharmaceutical and biotechnology markets.

Strong liquidity position

At the end of 2023, Cadence had cash and cash equivalents of $1.008 billion. Long-term debt was $299.8 million at December 31, 2023. It generated operating cash flow of $1.349 billion compared to $1.242 billion in the prior year. Free cash flow was $1.247 billion compared to $1.119 billion a year ago.

Strong cash flows help Cadence continue with shareholder-friendly initiatives. Fewer shares outstanding help the bottom line. It repurchased $125 million of stock in the fourth quarter and $700 million in 2023. CDNS expects to use 50% of free cash flow to repurchase stock in 2024.

Headwinds persist

Higher costs, strong competition and weak global macroeconomic conditions continue to be a problem for CDNS.

Also, management guidance for the first quarter of 2024 was lower than reported actuals in the prior year quarter.

For the first quarter of 2024, revenues are estimated between $990 million and $1.01 billion. The company reported sales of $1.022 billion last quarter.

The acquisitions have affected its balance sheet as high levels of goodwill and intangible assets increase the risk of investing in the company. The company’s goodwill and intangible assets totaled $1.873 billion or 33% of total assets as of December 31, 2023.

Moreover, management added that the BETA CAE acquisition is expected to reduce 2024 earnings per share by approximately 12 cents. The company anticipates the business will grow in 2025, based on Cadence’s strategy of paying down debt and repurchasing stock.

Other stocks to consider

Some other top-ranked stocks worth considering in the broader tech space are Manhattan Associates MANH, Synopsis SNPS i Microsoft MSFT. While Manhattan Associates and Synopsys each have a Zacks Rank #1, Microsoft currently has a Zacks Rank of 2 (Buy). You can see a complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MANH’s 2024 EPS has risen 3.6% in the last 60 days to $3.76. Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, an average surprise of 27.6%. MANH shares have risen 74% in the past year.

The Zacks Consensus Estimate for SNPS’s fiscal 2024 EPS increased 1% over the last 60 days to $13.56. The long-term earnings growth rate is 17.5%. SNPS’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 4.1%. SNPS shares have jumped 58.8% in the past year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2024 earnings per share is pegged at $11.63, indicating growth of 18.6% from a year ago. Microsoft’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, an average surprise of 8.8%. The long-term earnings growth rate is 16.2%. Shares of MSFT are up 56.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today you can download the 7 best stocks for the next 30 days. Click to get this free report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research