Let’s explore the relative performance of Appian ( NASDAQ:APPN ) and its peers as we reveal the automation software earnings season that has now ended in the fourth quarter.

The whole purpose of the software is to automate tasks to increase productivity. Today, new innovative software techniques, often involving AI and machine learning, are finally enabling automation that has moved from simple one- or two-step work processes to more complex processes that are an integral part of the enterprise. The result is an increasing demand for modern automation software.

6 Automation Software Stocks We Follow Report Strong Q4; on average, revenue beat analyst consensus estimates by 4.5%, while revenue guidance for the next quarter was 1.8% below consensus. Multiple estimates for growth stocks have returned to their historical averages after hitting highs in early 2021, but automation software stocks have held up better than others, with share prices up an average of 8.2% from previous results earnings.

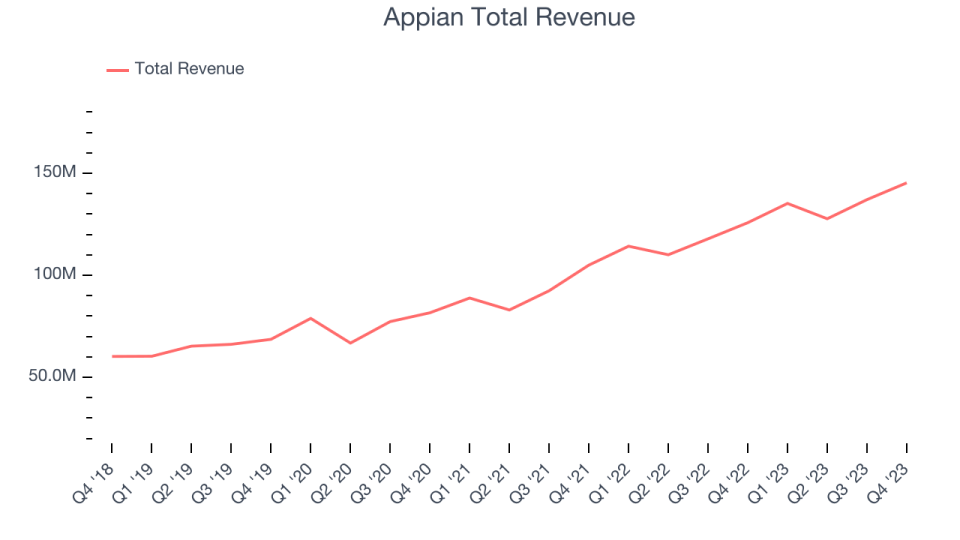

Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends from an apartment in Northern Virginia, Appian ( NASDAQ:APPN ) sells a software platform that allows its users to build apps without using a lot of code, allowing them to build new software faster.

Appian reported revenue of $145.3 million, up 15.5% year-over-year, beating analysts’ expectations by 3.2%. It was a solid quarter for the company, with a decent beat on analysts’ charge estimates and a significant improvement in its gross margin.

“Appian met our 2023 plan and achieved two milestones. Full year revenue exceeded half a billion dollars and we achieved the highest quarterly gross margin in our public history,” said Matt Calkins, CEO and founder.

The stock is up 17.2% since the results and is currently trading at $39.01.

Is now the time to buy Appian? Access our full earnings performance analysis here, it’s free.

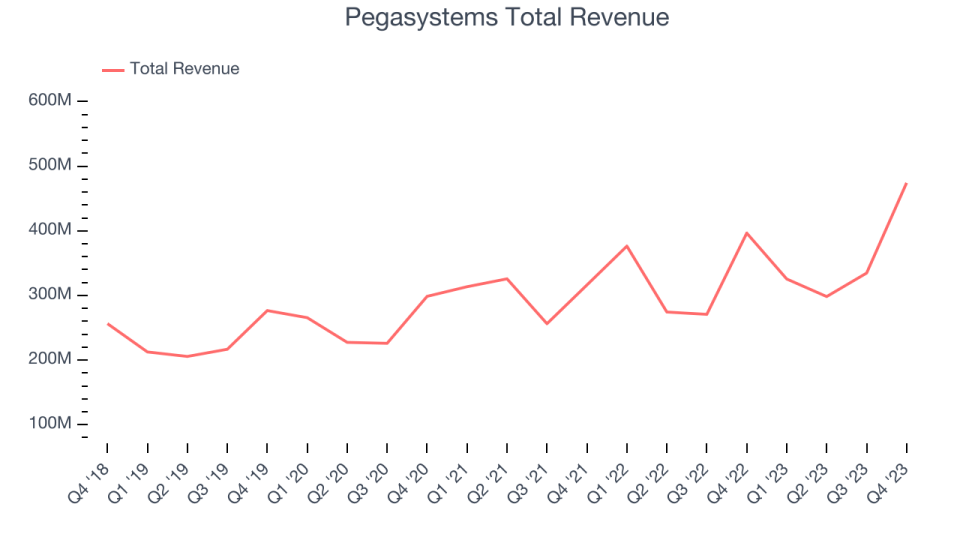

Best Q4: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize customer service and engagement workflows.

Pegasystems reported revenue of $474.2 million, up 19.6% year over year, beating analysts’ expectations by 14.2%. It was an incredible quarter for the company, impressively beating analysts’ charge estimates and significantly improving its gross margin.

Pegasystems achieved the highest number of analyst estimates among its competitors. The stock is up 27.5% since the results and is currently trading at $64.64.

Is now the time to buy Pegasystems? Access our full earnings performance analysis here, it’s free.

Weakest Q4: Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, just as Apple began to dominate the PC market, Jamf (NASDAQ:JAMF) provides software to businesses to manage Apple devices such as the Mac, iPad and iPhone.

Jamf reported revenue of $150.6 million, up 15.6% year over year, beating analysts’ expectations by 1.4%. It was a weak quarter for the company, with full-year revenue guidance that fell short of analysts’ expectations and revenue guidance for next year was unfavorable.

Jamf had the weakest full-year updated guidance of the group. The stock is down 9.8% since the results and is currently trading at $17.98.

Read our full analysis of Jamf’s results here.

Everbridge (NASDAQ:EVBG)

Founded in response to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) delivers software that helps governments and businesses protect people and infrastructure in emergencies.

Everbridge reported revenue of $115.8 million, down 1.2% year over year, in line with analyst expectations. It was a very good quarter for the company, impressively beating analysts’ billings estimates and narrowly beating analysts’ revenue estimates.

Everbridge has agreed to be taken private by Thoma Bravo for $28.60 per share in cash ($1.5 billion in total).

Everbridge underperformed analysts’ estimates and had the slowest revenue growth among competitors. The stock is up 22% since the results and currently trades at $34.55.

Read our full report on Everbridge here, it’s free.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy, who wrote the code for the company’s initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) offers a software-as-a-service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR and service for users.

ServiceNow reported revenue of $2.44 billion, up 25.6% year-over-year, beating analysts’ expectations by 1.5%. It was an impressive quarter for the company, with a decent beat on analysts’ revenue estimates and accelerated growth from major customers.

The company added 108 enterprise clients paying more than $1 million a year to reach a total of 1897. The stock is down 0.5% on the results and is currently trading at $761.35.

Read our full, actionable report on ServiceNow here, it’s free.

Join paid stock investor research

Help us make StockStory more useful to investors like you. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Apply here.