Welcome to the forefront of the artificial intelligence (AI) revolution, where turning the mundane into the extraordinary is just another day at the office. Three Motley Fool contributors, each with a keen eye on the AI landscape, have teamed up to share their top AI investment recommendations as March turns into April.

It’s quite a composition. UiPath (NYSE: PATH) makes routine extraordinary. Chips from Nvidia (NASDAQ: NVDA) currently training your favorite AI platforms. AND Broadcom (NASDAQ: AVGO) is building the world’s AI infrastructure, one network chip at a time.

How UiPath stands out in the AI market

Anders Bylund (UiPath): The UiPath business automation specialist’s place in the world is quite simple. By automating simple, mundane, and repetitive tasks in a company’s day-to-day operations, employees can instead focus their efforts on innovative, value-added functions.

After implementing UiPath’s AI-driven robots in their daily uninspiring jobs, clients tend to save costs and speed up core processes. With the newfound freedom to pursue more fulfilling projects, their employees become happier and more efficient.

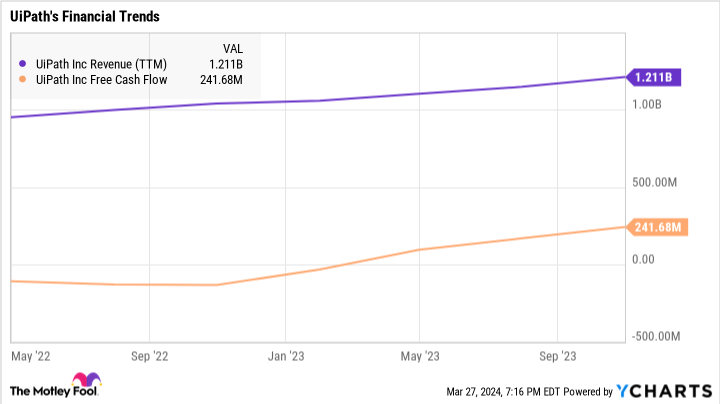

So it’s no surprise to see UiPath’s business flourishing in the ongoing AI boom. Sales were up 31% year over year in the recently released fourth quarter report. Free cash flow was essentially flat in the 2023 fiscal year ending January 31, 2023, just a few weeks after OpenAI’s introduction of ChatGPT. A year later, for fiscal 2024, UiPath generated $309 million in free cash flow on $1.3 billion in headline revenue. In other words, the public craze for AI tools has increased the company’s cash-based profit margin from zero to 24% in just one year.

This should be the start of a sustained growth spurt. AI tools are currently an easy sell, and the company enjoys strong word-of-mouth marketing when new customers leave happier and richer.

But no one has yet spread the word on Wall Street. UiPath trades at 10 times sales and 34 times earnings estimates. These ratios would be suitable for a moderately growing retailer or basic materials manufacturer. For a software specialist with high margins and skyrocketing sales, they look like a good deal.

So if you’re looking for a modestly priced AI stock with a generous dose of nitro in its sales growth engines, UiPath deserves another look. This offer is hard to beat, even if you’ve focused UiPath’s automation tools on the problem. Cathie Wood is a first hand stock buy these days and you should consider following her.

Broadcom: Now much more than just another chip vendor

Billy Duberstein (Broadcom): Although it has seen great success, Broadcom may still be underrated in AI.

The stock trades at 28 times this year’s earnings estimates, but the company has regularly beaten analysts’ estimates, so it’s a pretty good bet that Broadcom will beat earnings estimates again this year. That’s especially true as its two AI chip divisions appear poised for strong growth.

Broadcom’s first AI chip segment includes merchant networking chips, where Broadcom leads Ethernet communications through its Tomahawk switching chips, Jericho routing chips, and optical transceiver chips that all work together to enable lightning-fast communications.

Another AI division makes custom ASIC chips that combine with user IP to form custom AI accelerators for special purposes. For example, Alphabet uses Broadcom’s IP in its custom tensor processing units and Meta platform is another key customer. Each of these two mega-clients brings in a lot of money for Broadcom, especially over the past year when AI applications have taken off.

Recently, Broadcom raised its outlook for AI chip sales growth in 2024, predicting that AI revenue will reach 35% of semiconductor revenue this year, while totaling more than $10 billion. That’s up from the 25% share it predicted in the previous quarter.

Not only that, but since the earnings announcement, Broadcom has announced a third ASIC buyer, which is no doubt a large tech company that will grow significantly in the coming years. So its AI revenue could even exceed what management predicted in its recent earnings report.

Still, while the AI chip segment is booming, Broadcom also revealed exciting news regarding its software segment, which grew significantly with the acquisition of VMware last November.

With that acquisition, software accounts for nearly half of Broadcom’s revenue. But it also appears that VMware’s business could take a hit on a standalone basis — which is convenient for shareholders, right after Broadcom closed on the purchase. On a recent conference call with analysts, CEO Hock Tan said he sees VMware growing in double digits sequentially every quarter through this year.

That would be a serious acceleration from VMware’s pre-acquisition growth, reflecting price increases for the new VMware Cloud Foundation product. This premium product is an integrated software suite that virtualizes all aspects of a customer’s compute, storage, networking, and even AI GPUs in their on-premises data centers. Hardware virtualization is the process of creating virtual versions of physical desktops and operating systems — its benefits include better performance and lower costs.

In the new world of artificial intelligence, it is likely that corporate users will work between on-premises data centers and public clouds, depending on the capabilities of each. It’s also likely that companies will want to use cloud-based AI tools, but will also be wary of sharing their data outside of their own on-premises data centers. In that world, VMware should be even more valuable as the connective tissue between all these computing environments.

But perhaps the bigger point is that Broadcom is now more than just a chipmaker. As the only technology platform with a roughly 50/50 split between chips and software, it can now also look to hardware and software world for future acquisitions. Given that the company’s business model is focused on acquisitions, investors may not realize how much its growth prospects have increased with the acquisition of VMware.

As such, despite a 116% gain over the past year, Broadcom stock still looks like it’s undervalued compared to other AI darlings.

Are we closer to Nvidia’s peak than investors believe?

Nicholas Rossolillo (Nvidia): Nvidia has had meteoric rises in the past, but this one has been taking the cake for the past two years. As the superpower responsible for starting the AI race, Nvidia’s name (rooted in the Latin “invidia” for envy, a sentiment that co-founders, including CEO Jensen Huang, wanted to inspire among competitors) became a self-fulfilling prophecy as the semiconductor industry and the technology sector in general fell into disrepair. orbit of the company.

Of course, we are far from Nvidia being the leader only in graphics processing. The company’s GPUs have become the backbone of new generative AI training, as well as for many AI inferences (after an AI system is trained and deployed).

Huang recently said that his company is at the forefront of two giant markets. The first is the enormous task of upgrading the existing fleet of global data centers to hardware for accelerated computing. And the other is the new generative artificial intelligence market that needs brand new purpose built data centers.

The market for generative artificial intelligence, specifically aimed at training artificial intelligence, is already dominated by Nvidia. Its total value is still unknown, but it could be worth hundreds of billions of dollars in total data center assets in the next few years.

The existing global data center market is currently estimated at $1 trillion. The hardware within this huge computing footprint tends to be upgraded every four to five years. And right now, the upgrades needed are accelerated computing — the very kind of chips that Nvidia has become synonymous with.

Paired with new Installing generative AI infrastructure, this existing data center upgrade cycle is why one of Nvidia’s main rivals, AMD (NASDAQ: AMD)said that total sales of computing-accelerated chips could reach $400 billion in 2027.

Given Nvidia’s absolute dominance up to this point, this huge opportunity is why the company now commands an absurd market cap of $2.3 trillion — or 37 times the current year’s expected earnings per share. This ranks Nvidia as one of the most valued companies in the world (one of the “magnificent seven”), although its actual revenues and profits are still far behind those of the largest companies. Investors believe that Nvidia will remain in high growth for some time.

And it will grow. Management has provided early guidance that assumes another year of huge growth in 2024. For reference, the Wall Street analyst consensus is now for revenue to grow at least 80% this year, with profit margins still near historic highs.

Given these assumptions, investors who don’t already own Nvidia should be cautious. Its business is cyclical and at some point the AI infrastructure building frenzy will moderate and go through a cyclical downturn. But are we close to the peak of Nvidia’s sales? It sure doesn’t look like it.

Should you invest $1000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

The Motley Fool Stock Advisor a team of analysts has just identified what it believes to be 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. Ten Stocks That Dimmed Could Produce Monster Returns in the Coming Years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio construction guidance, regular updates from analysts, and two new stock picks each month. The Stock Advisor the service has more than tripled the return of the S&P 500 since 2002*.

See 10 stocks

*Stock Advisor returns from March 25, 2024

Randi Zuckerberg, former director of market development and Facebook spokesperson and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, CEO of Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and Nvidia. Billy Duberstein holds positions at Alphabet, Broadcom and Meta Platforms. His clients may have shares of the mentioned companies. Nicholas Rossolillo holds positions at Advanced Micro Devices, Alphabet, Broadcom, Meta Platforms, Nvidia and UiPath. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, Nvidia and UiPath. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

From Silicon to Software: A Quick and Easy Guide to Investing in Artificial Intelligence This Spring was originally published by The Motley Fool