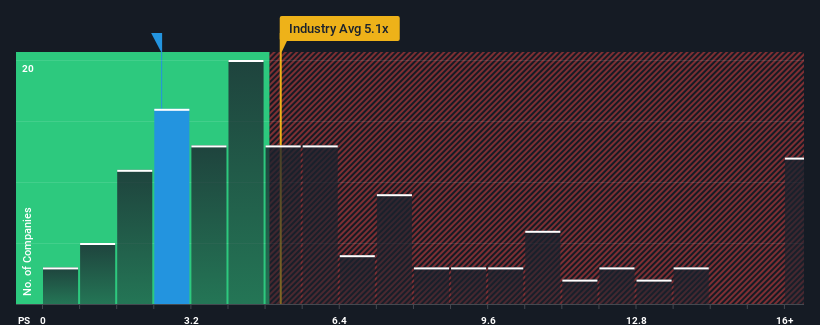

You might think that with a price-to-sales ratio (or “P/S”) of 2.5x Youkeshu Technology Co., Ltd (SZSE:300209) is definitely a stock worth checking out, given that almost half of all software companies in China have a P/S ratio of more than 5.1x, and even a P/S above 9x is not uncommon. Although, it is not wise to just take P/S at face value as there may be an explanation for why it is so limited.

Check out our latest analysis for Youkeshu TechnologyLtd

How Youkeshu TechnologyLtd was successful

For example, Youkeshu TechnologyLtd’s recent decline in revenue should be food for thought. Perhaps the market believes that recent earnings performance is not good enough to keep up with the industry, causing damage to the P/S ratio. If you like the company, you’d hope that’s not the case so you could potentially pick up some shares while it’s out of grace.

Want a complete picture of your company’s earnings, revenue and cash flow? Then ours free report on Youkesh TechnologyLtd will help you shed light on its historical performance.

What do revenue growth metrics tell us about a low P/S?

To justify its P/S ratio, Youkeshu TechnologyLtd would need to produce anemic growth that lags well behind the industry.

Looking back first, the company’s revenue growth last year was nothing to get excited about as it saw a disappointing 46% decline. This means that it has also seen a long-term decline in revenue as revenues have fallen by 90% overall over the past three years. So it’s fair to say that recent revenue growth has been unwelcome for the company.

By contrast, the rest of the industry is expected to grow 34% over the next year, which really puts the company’s recent mid-term revenue decline into perspective.

In light of this, it is understandable that Youkeshu TechnologyLtd’s P/S would be below most other companies. However, we believe that the decline in revenue is unlikely to lead to a stable P/Sa in the long term, which could lead to future disappointment for shareholders. Even just sustaining these prices could be difficult to achieve as recent revenue trends are already weighing on the stock.

Key to get out

The price-to-sales ratio is argued to be an inferior measure of value within certain industries, but it can be a powerful indicator of business sentiment.

As we suspected, our examination of Youkeshu TechnologyLtd found that its medium-term revenue decline is contributing to a low P/S, given that the industry is set to grow. At this stage, investors believe that the potential for revenue improvement is not large enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will see any significant movement in either direction in the near term if recent medium-term earnings trends continue.

Having said that, be aware Youkeshu TechnologyLtd shows 3 warning signs in our investment analysis, and 2 of them do not fit us very well.

If you are I am not sure about the business strength of Youkeshu TechnologyLtdwhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we help make it simple.

Find out if Youkeshu Technology Ltd is potentially overrated or underrated by checking our extensive analysis, which includes fair value estimates, risks and caveats, dividends, preferential transactions and financial health.

Check out the free analysis

Have feedback on this article? Concerned about content? Get in touch directly with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account recent price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.