To the annoyance of some shareholders, Beijing Tongtech Co., Ltd. (SZSE:300379) shares have fallen a significant 27% in the past month, continuing a terrible streak for the company. For all long-term shareholders, the last month caps off a year to forget by locking in a 62% decline in the share price.

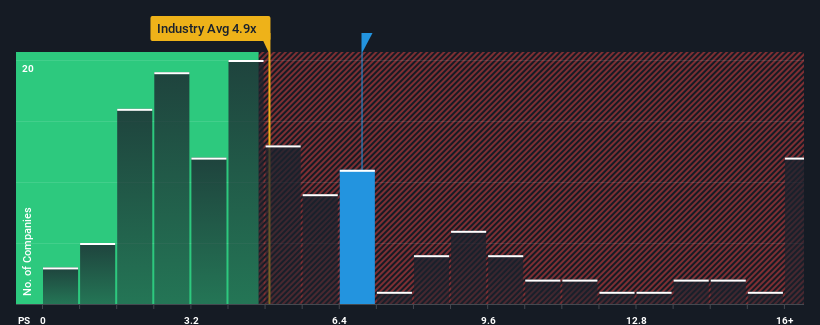

Even after such a big drop in price, when almost half of the companies in China’s software industry have a price-to-sales ratio (or “P/S”) below 4.9x, you can still consider Beijing Tongtech a stock that probably isn’t worth exploring with its 6, 9x P/S ratio. Even so, we would have to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Beijing Tongtech

What does Beijing Tongtech P/S mean for shareholders?

With revenue growth that is superior to most other companies recently, Beijing Tongtech is doing relatively well. Many seem to expect strong revenue to be sustained, which has boosted the P/S. However, if this is not the case, investors could be caught paying too much for the stock.

Want a complete picture of analyst estimates for a company? Then ours free Beijing Tongtech’s report will help you discover what’s on the horizon.

Is sufficient revenue growth predicted for Beijing Tongtech?

To justify its P/S ratio, Beijing Tongtech would need to produce impressive industry-beating growth.

Looking back first, we see that the company grew revenue by an impressive 15% last year. The last three-year period also saw an excellent overall revenue increase of 97%, supported by short-term results. So we can start by confirming that the company has done a great job of growing revenue over that time.

Moving forward, estimates from the only analyst covering the company indicate that revenue should grow 44% over the next year. Meanwhile, the rest of the industry is forecast to expand by just 28%, which is noticeably less attractive.

With this information, we can see why Beijing Tongtech is trading at such a high P/S compared to the industry. Obviously, shareholders don’t want to get rid of something that potentially looks to a more prosperous future.

Conclusion on P/S of Beijing Tongtech

There is still some upside in Beijing Tongtech’s P/S, even if that can’t be said for the recent share price. We would argue that the power of the price-to-sales ratio is not primarily as a valuation tool, but rather in assessing current investor sentiment and future expectations.

We find that Beijing Tongtech is maintaining its high P/S thanks to forecasted revenue growth being higher than the rest of the software industry, as expected. At this stage, investors believe that the potential for earnings deterioration is quite small, which justifies the elevated P/S ratio. Unless analysts really missed the mark, these strong revenue forecasts should keep the stock price high.

You should always think about the risks. The case we observed 2 warning signs for Beijing Tongtech you should be aware.

If companies with solid past earnings growth are your preferenceyou might like to see this free a collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we help make it simple.

Find out if Beijing Tongtech is potentially overrated or underrated by checking our extensive analysis, which includes fair value estimates, risks and caveats, dividends, preferential transactions and financial health.

Check out the free analysis

Have feedback on this article? Concerned about content? Get in touch directly with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the company’s latest price-sensitive announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.