The end of earnings season is always a good time to take a step back and see who shined (and who didn’t). Let’s take a look at how software development stocks fared in the fourth quarter, starting with GitLab ( NASDAQ:GTLB ) .

As legendary VC investor Marc Andreessen says, “Software is eating the world” and it touches almost every industry. This is driving increasing demand for tools that help software developers do their jobs, whether it’s monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a mixed Q4; on average, revenue beat analysts’ consensus estimates by 3%, while revenue guidance for the next quarter was 0.8% above consensus. Multiple estimates for growth stocks have returned to their historical averages after hitting highs in early 2021, but software development stocks have held up better than others, with share prices up an average of 0.3% since prior earnings results .

GitLab (NASDAQ:GTLB)

Founded as an open source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

GitLab reported revenue of $163.8 million, up 33.3% year over year, beating analyst expectations by 3.5%. It was a mixed quarter for the company, with analysts impressively beating revenue estimates, but full-year revenue guidance fell short of analyst expectations.

“We had a strong fourth quarter and continue to see large enterprise customers standardize on GitLab to drive business value,” said Sid Sijbrandij, GitLab CEO and co-founder.

GitLab achieved the fastest revenue growth of the entire group. The stock is down 20.2% since the results and is currently trading at $59.4.

Is now the time to buy GitLab? Access our full earnings performance analysis here, it’s free.

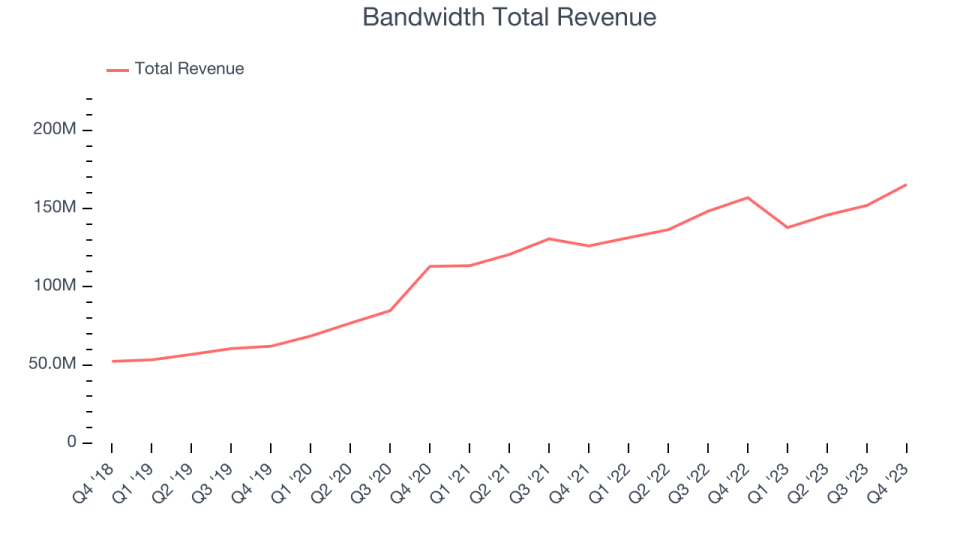

Best Q4: Bandwidth (NASDAQ:BAND)

Started in 1999 by David Morken and later joined by Henry Kaestner as a co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice and text connectivity.

Bandwidth reported revenue of $165.4 million, up 5.4% year-over-year, beating analysts’ expectations by 7.4%. It was a good quarter for the company, with upbeat revenue forecasts for the next quarter. On the other hand, its gross margin fell, signaling that the company’s prices have come under some pressure.

Bandwidth posted the biggest beat on analyst estimates and the biggest increase in full-year guidance among peers. The stock is up 45.9% since the results and is currently trading at $17.75.

Is Now the Time to Buy Bandwidth? Access our full earnings performance analysis here, it’s free.

Weakest Q4: Akamai (NASDAQ:AKAM)

Founded in 1999 by two MIT engineers, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenue of $995 million, up 7.2% year over year, below analysts’ expectations of 0.5%. It was a weak quarter for the company, with lackluster revenue guidance for the next quarter and missing analysts’ revenue estimates.

Akamai was the weakest performer relative to analyst estimates in the group. The stock is down 13.3% since the results and is currently trading at $108.5.

Read our full analysis of Akamai’s results here.

Dynatrace (NYSE:DT)

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that enables them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace reported revenue of $365.1 million, up 22.7% year-over-year, beating analysts’ expectations by 2.1%. It was a mixed quarter for the company, with analysts decently beating estimates. And while full-year revenue guidance was higher than Wall Street estimates, full-year ARR (annual recurring revenue) came in below expectations.

The stock is down 23.7% since the results and is currently trading at $46.28.

Read our full report on Dynatrace here, it’s free.

F5 (NASDAQ:FFIV)

Originally a hardware device company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting against cyberattacks.

F5 reported revenue of $692.6 million, down 1.1% year-over-year, beating analysts’ expectations by 1.1%. It was a very good quarter for the company, with an impressive outperformance of analysts’ earnings estimates and strong sales guidance for next quarter.

F5 had the slowest revenue growth among its peers. The stock is up 0.8% since the results and is currently trading at $186.87.

Read our full F5 report here, it’s free.

Join paid stock investor research

Help us make StockStory more useful to investors like you. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Apply here.